Adding Satellites

Building a Compounding Machine: Part Two

Please read the disclaimer before proceeding.

In the first article of this series, I focused on laying a foundation of global equities alongside a protective allocation to physical gold. For some investors who want to take a broadly passive approach and/or who are in the early stages of growing their fund, this might be sufficient. However, investors who prefer to take a more active approach might want to consider adding satellites to the core global allocation with a view to enhancing returns and/or generating higher dividends.

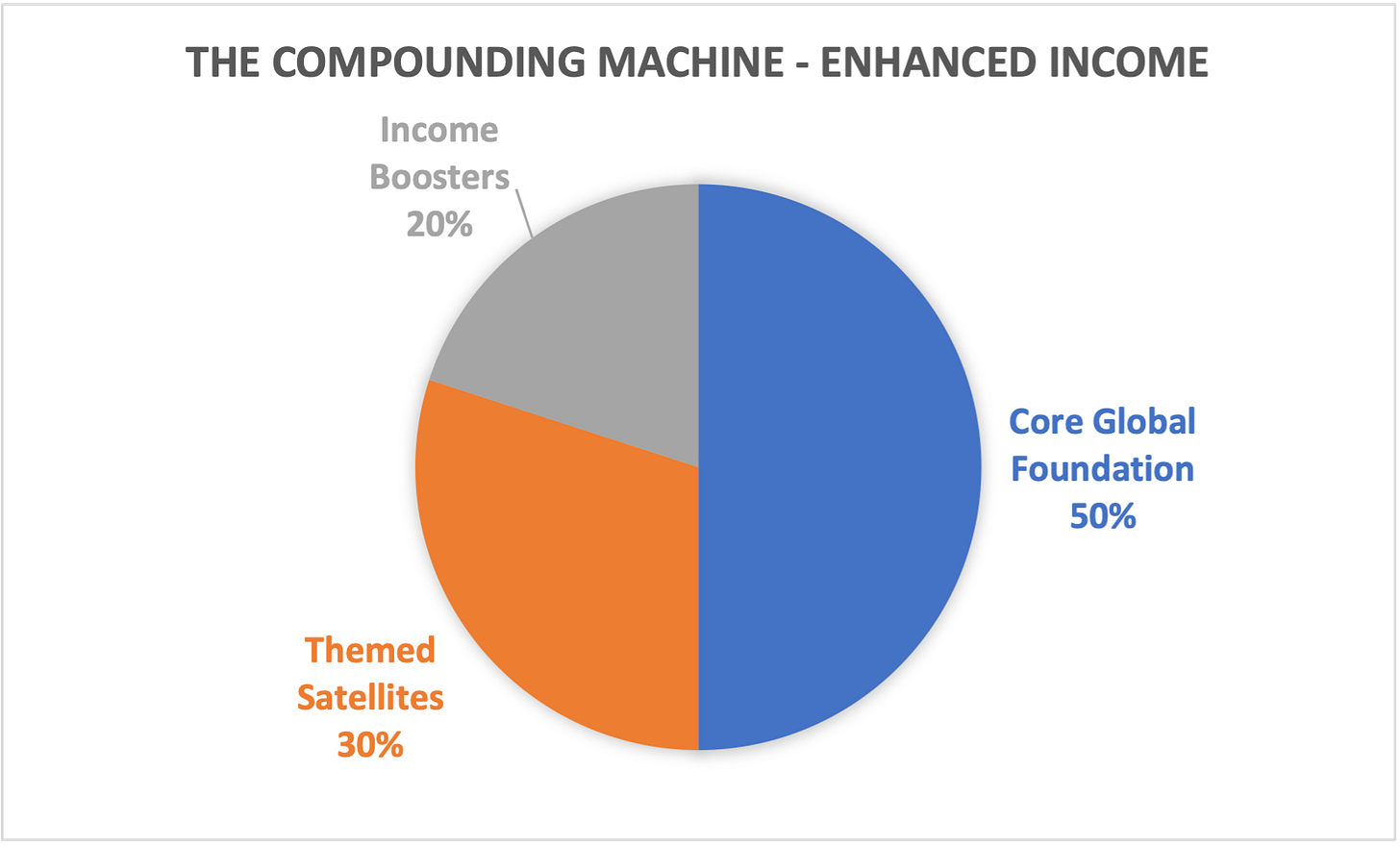

To that end, I’m going to create two model portfolios, by way of example. The first will be an enhanced income version that will consist of 50% Global Foundation, 30% Themed Satellites and 20% Income Boosters.

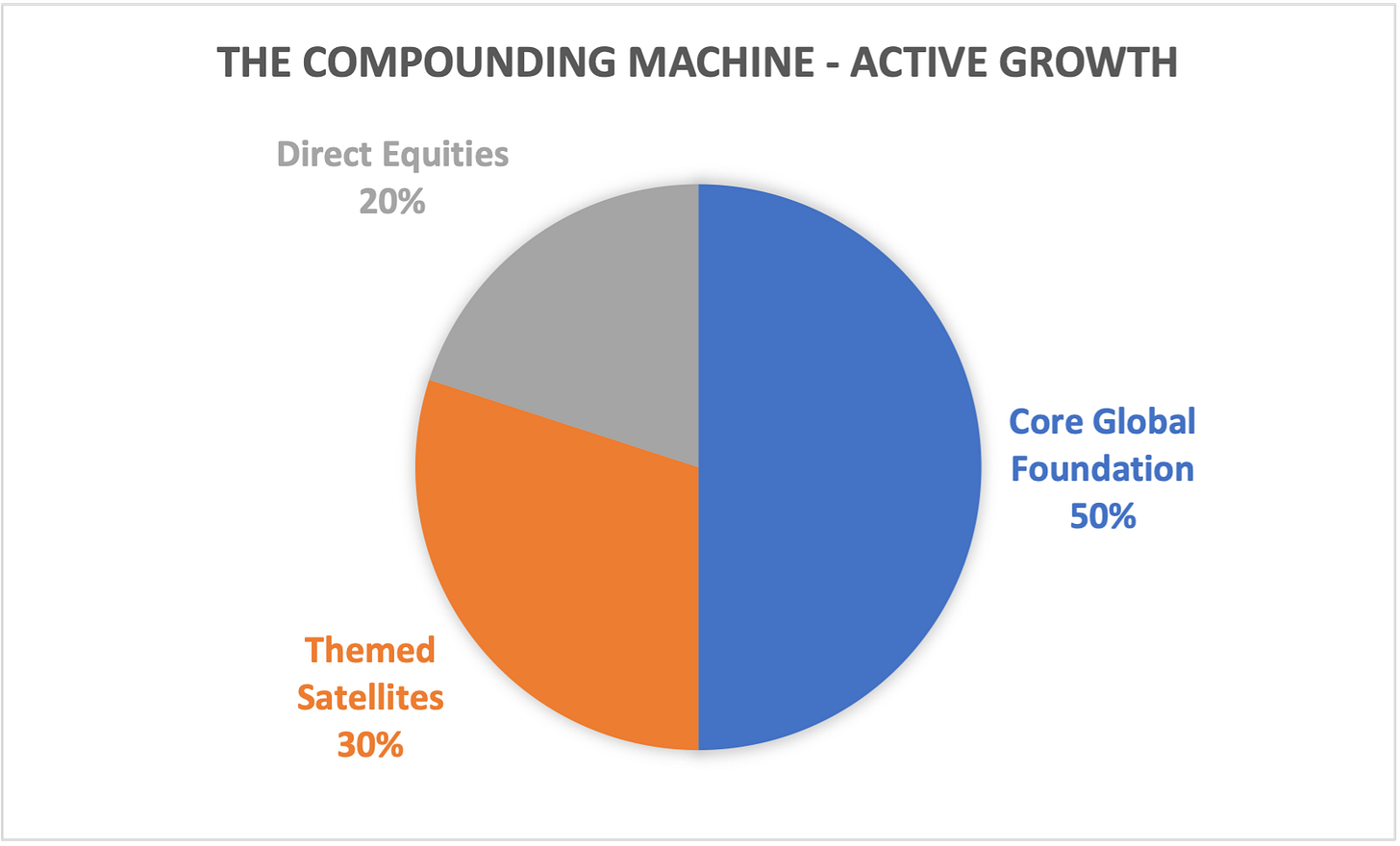

The second (which I shall complete in the third article in this series) will be a slightly more active growth version that will consist of direct equities in place of the income boosters.

In this article, I will explore a range of satellite options across 9 themes. This is not an exhaustive list and these themes will change from year to year based on market dynamics. Nonetheless, it will give subscribers a process and range of ideas to help build your own Compounding Machine. The other point to note is that this model portfolio is purely by way of example. Each compounding machine has the option of including different funds and applying different weights to suit the needs and risk appetite of each person.

Theme 1 – Gold Miners

I am on record as saying that I generally dislike investing in mining companies. They tend not to be very good compounders because they are dependent on the price of the commodity, are not in control of their input costs and require continuous capital expenditure as well as having to mitigate external risks such as political interference. However, we find ourselves in an unusual moment of financial history. The gold price has consolidated above $4,000 per ounce against typical mining costs of $2,000-2,500 per ounce. This means that mining companies are currently making very healthy profits and while some of this expectation is already in the price of gold mining companies (e.g. several specialist funds are up over 100% this year), the longer the price stays above $4,000, the more valuable mining companies will become.

It is impossible to know if and when the gold price has peaked. My own interpretation of events is that there are several factors at play that might lead to even higher gold prices over the next year or two in which case gold mining funds are likely to perform very well. However, the reverse is also true and anyone investing in this sector has to be prepared to monitor the underlying commodity price and the associated factors that might affect it.

In my own portfolio, I invest in gold miners via the iShares ETF (SPGP) for exposure to the larger companies and for the smaller companies, the investment trust Golden Prospect Precious Metals (GPM) which has an unusual way of rewarding shareholders via subscription options (this is very effective when prices are increasing). There are also two specialist gold mining ETFs from VanEck; GDX for the majors and GDXJ for the juniors.

All of the four funds mentioned above are accumulation products where dividends received are reinvested within the fund. For UK investors who want to generate an income from their investment in this sector, the Blackrock World Mining (BRWM) investment trust provides an alternative but only a portion of the fund is allocated specifically to gold miners.

Theme 2 - Technology

Technology has been one of the best sectors to generate compound returns from over the past 20 years and over the long-term one would expect that to continue to be true, even if the individual names might change along the way. That said, valuations in this US led sector are at the top end of historical norms. For this reason and also because there is inevitably some overlap with the global equity funds, our model portfolio will only have an allocation to one company in this sector. Generally, I see three main options; a Nasdaq 100 ETF such as the iShares CNX1 or via an active investment trust manager such as Alliance Technology Trust (ATT) or Polar Capital Technology (PCT).

Theme 3 – Private Equity

Private Equity (i.e. companies that are owned privately rather than being listed on a public exchange) have had a tough time over the past few years with higher interest rates hampering performance and therefore, returns. Many of the trusts in this sector currently have hefty discounts as a result. This can be seen clearly in the sector graphic below from the AIC website. Private Equity funds also tend to charge higher fees than general equity funds but when it is hot, this sector tends to outperform.

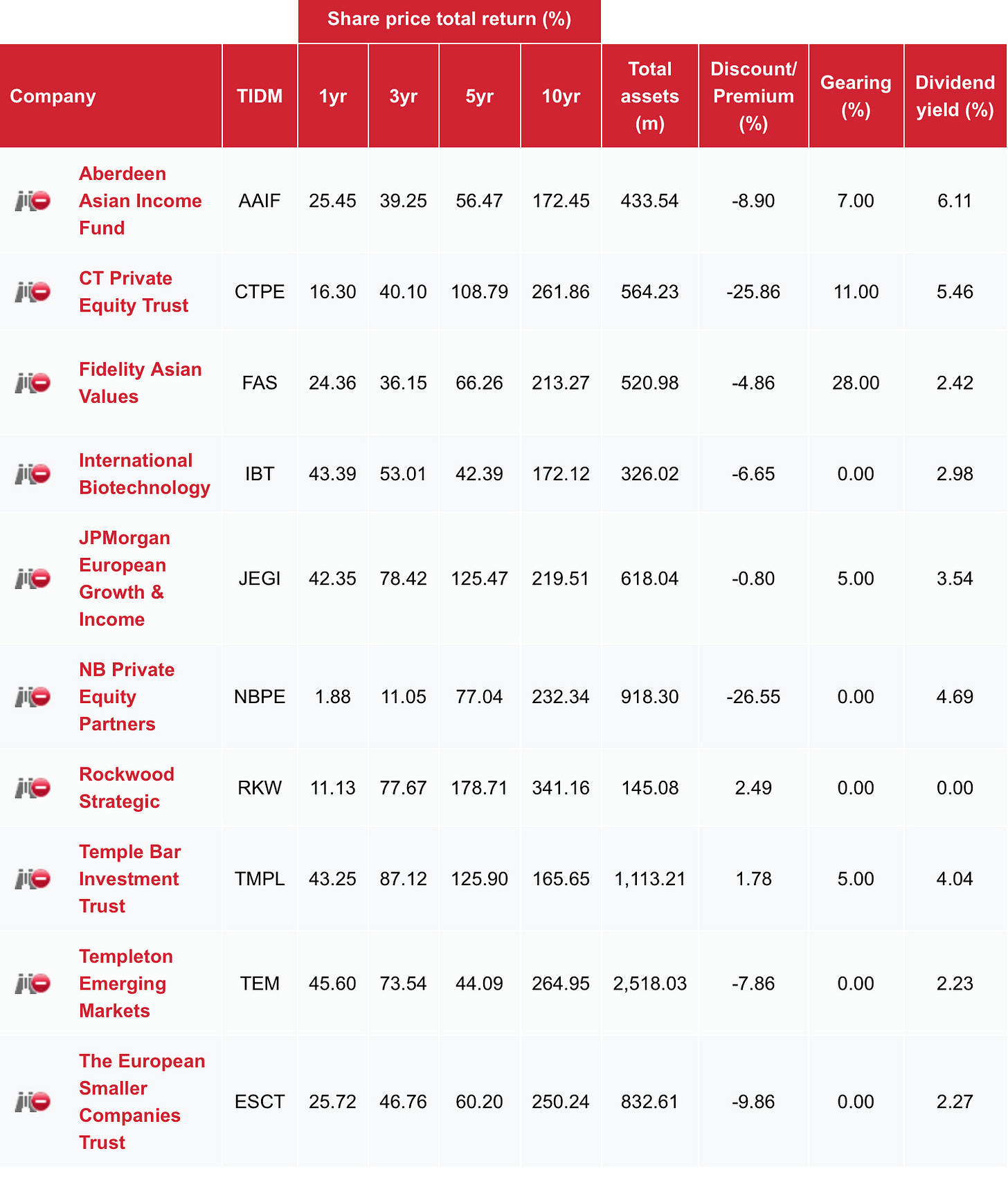

Personally, I like the diversification offered by CT Private Equity (CTPE) that combines investing in other private equity funds with direct investment in specific co-pilot opportunities. It also pays a dividend that is currently around 5.5% per annum. NB Private Equity (NBPE) also offers an attractive dividend and has a good long-term track record.

With interest rates falling, there is every chance this sector could return to favour with the double benefit of rising asset values and a closing of the discounts. However, this is not guaranteed and the spectre of global recession and possibly stagflation also hovers in the background which could continue to surpress returns in the sector.

Theme 4 – Emerging Markets

Probably the main factor affecting the performance of emerging markets is the value of the dollar which has fallen by around 10% this year when measured against a basket of other currencies (i.e. the DXY index). President Trump seems determined to continue reducing the value of the dollar, especially by encouraging lower interest rates. This is part of his plan to rebuild America’s manufacturing base.

All things being equal (and of course they rarely are), a weaker dollar will lead to decent returns from the Emerging Markets sector where Fidelity (FEML), JP Morgan (JMGI) and Templeton (TEM) all offer interesting options. All of these pay a reasonable dividend. A slightly higher income version in this sector would be Blackrock Frontiers (BRFI) but this comes with a higher charge and potentially higher risk.

Theme 5 – UK

On a personal level I tend not to invest in UK oriented funds as I run my own portfolio of UK small and midcap companies. The UK Equity Income sector has a lot of options to choose from and in this regard both Vanguard (VUKE) and iShares (ISF) offer FTSE 100 ETFs that provide a similar yield. I gravitate towards Law Debenture (LWDB) and Temple Bar (TMPL) with Shires Income (SHRS) as an enhanced dividend option.

For growth funds in the UK, one probably needs to look toward smaller companies. Again, there are a lot of investment trusts to choose from in this sector but in my view there is one standout performer over all time frames, Rockwood Strategic (RKW) which is run by the excellent Richard Staveley. The problem here though is whether performance is dependent on a single star fund manager. In the short-term at least, I’d like to include it in the model portfolio.

Theme 6 – Europe

There are fewer investment trust options when one looks at the European sector but both Fidelity (FEV) and JP Morgan (JEGI) have good long-term track records.

In the smaller companies space there are only three options, all of them decent. My personal preference is for the European Smaller Companies Trust (ESCT) run by Janus Henderson. In 2026 their dividend policy will be changing to pay out 5% of their net asset value annually, so this trust should offer both growth and income going forward.

Theme 7 – Asia

There are some interesting investment trusts in this region, split into three sectors; Asia Pacific, Asia Pacific Equity Income and Smaller Companies. There is significant crossover in this region with some of the emerging market funds and for that reason, I shall be focusing mainly on the smaller companies sector for the model portfolio. There are two trusts that have comparable track records; Aberdeen Asia Focus (AAS) and Fidelity Asian Values (FAS).

That said, there are two trusts in this region that offer an enhanced dividend yield; Henderson Far East Income (HFEL) and Aberdeen Asian Income (AAIF).

Theme 8 – North America

The standout performer in this surprisingly small sector is JP Morgan American (JAM) and a higher income option is Blackrock American (BRAI). There is also the option of going for an S&P 500 ETF such as Vanguard’s VUSA. In terms of the model portfolio, it is worth noting that global ETFs and Investment Trusts tend to carry around 60% of their weight in American companies so adding satellites in this sector creates significant duplication.

Theme 9 – Biotechnology and Healthcare

With the western world suffering from an ageing population and technology leading to more rapid developments, this sector is worth paying attention to. That said, it is a sector that can be a bit patchy in terms of returns. International Biotechnology (IBT) has a comparable growth record while also offering a dividend yield at 4% of net asset value and is therefore the one that I will be including in the model portfolio.

Final Segment Selection

For the model portfolio I have decided to include 2 ETFs both from iShares – CNX1 for technology exposure and SPGP for exposure to gold miners. Neither of these ETFs pay a dividend. I have then selected 10 Investment Trusts, shortlisted from those discussed throughout this article.

The average dividend yield of these investment trusts is 3.8% or 3.16% when allowing for the two non-yielding ETFs in this portfolio segment.

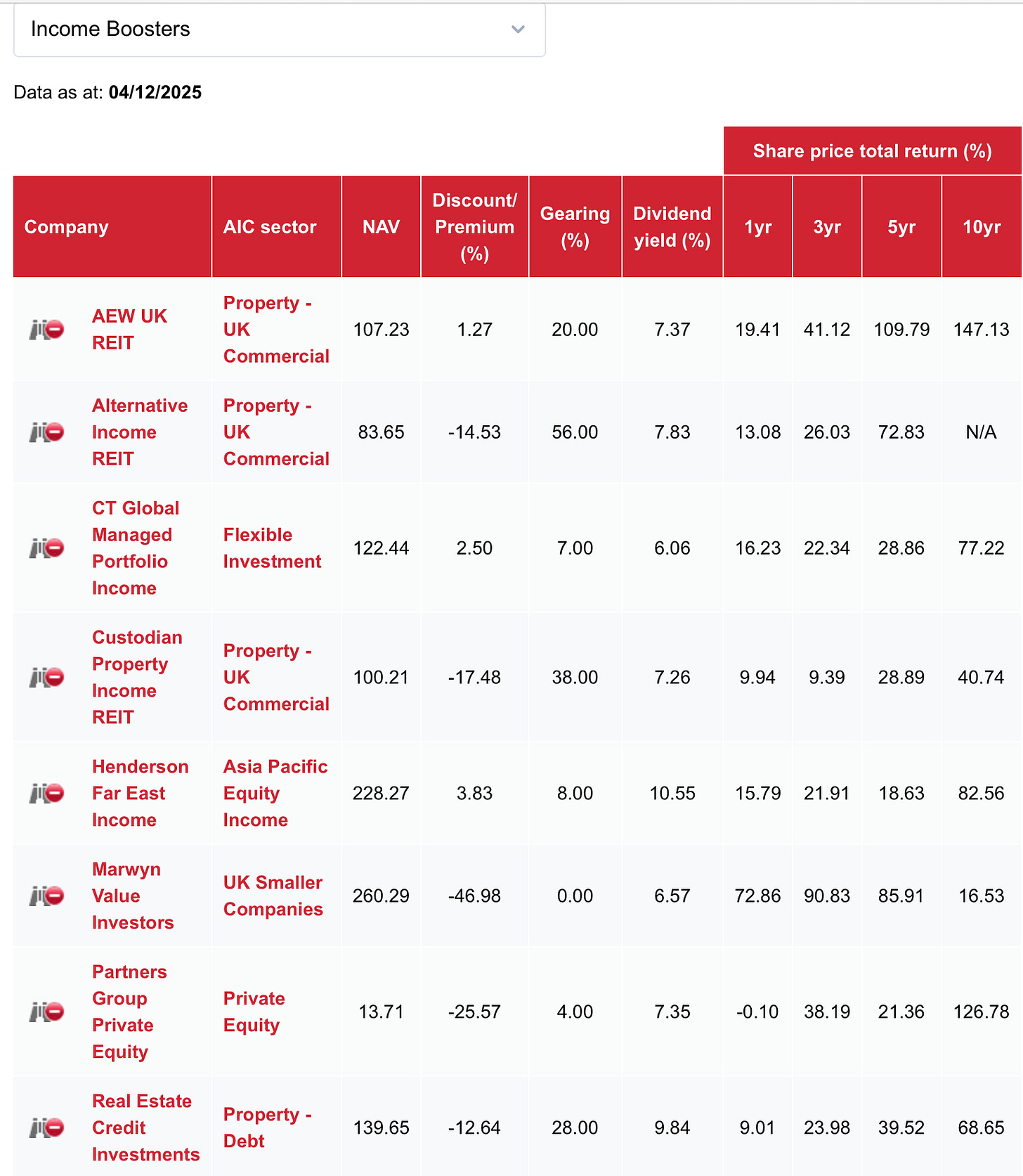

Income Boosters

I have cheated a little and included some non-equity funds (mainly property oriented but avoiding infrastructure and bond funds) to bring the yield in this segment up to nearly 8%. It should be noted that as a general rule, buying funds with higher yields than the norm tends to come at the expense of growth. That is, these funds can often be value traps. And that’s fine, as long as we know why we are owning them and the role they play in our diversified portfolios.

I have opted for 8 Investment Trusts in total, each with a 2.5% weighting. The average yield of this segment is 7.85%.

Natural Yield

The overall dividend yield of this version of the model portfolio is 3.8%. For portfolios that are in drawdown mode, the weightings can be adjusted to produce a higher yield but please note that there is likely to be a corresponding effect on growth within the portfolio.

Discussion

The model portfolio presented in this article is just one version of what a Compounding Machine might look like. I encourage subscribers to share their own versions and preferred funds in the comments selection below. This can then provide additional research ideas for other subscribers, for the collective benefit. I also welcome challenge, so if you don’t agree with any of my inclusions in the model portfolio, please also feel free to say so in the comments section below.

And if you haven’t done so already, please subscribe for FREE so that you can receive all new articles directly to your inbox.

Disclosure

At the time of writing, the author owns shares in the iShares Gold Producers ETF, SPGP and the investment trust Golden Prospect Precious Metals, GPM which were mentioned in this article. No other funds mentioned in this article are currently owned by the author but they might be in the future. The author’s latest quarterly holdings disclosure can be viewed here.