The Compounding Machine

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Albert Einstein

Introduction

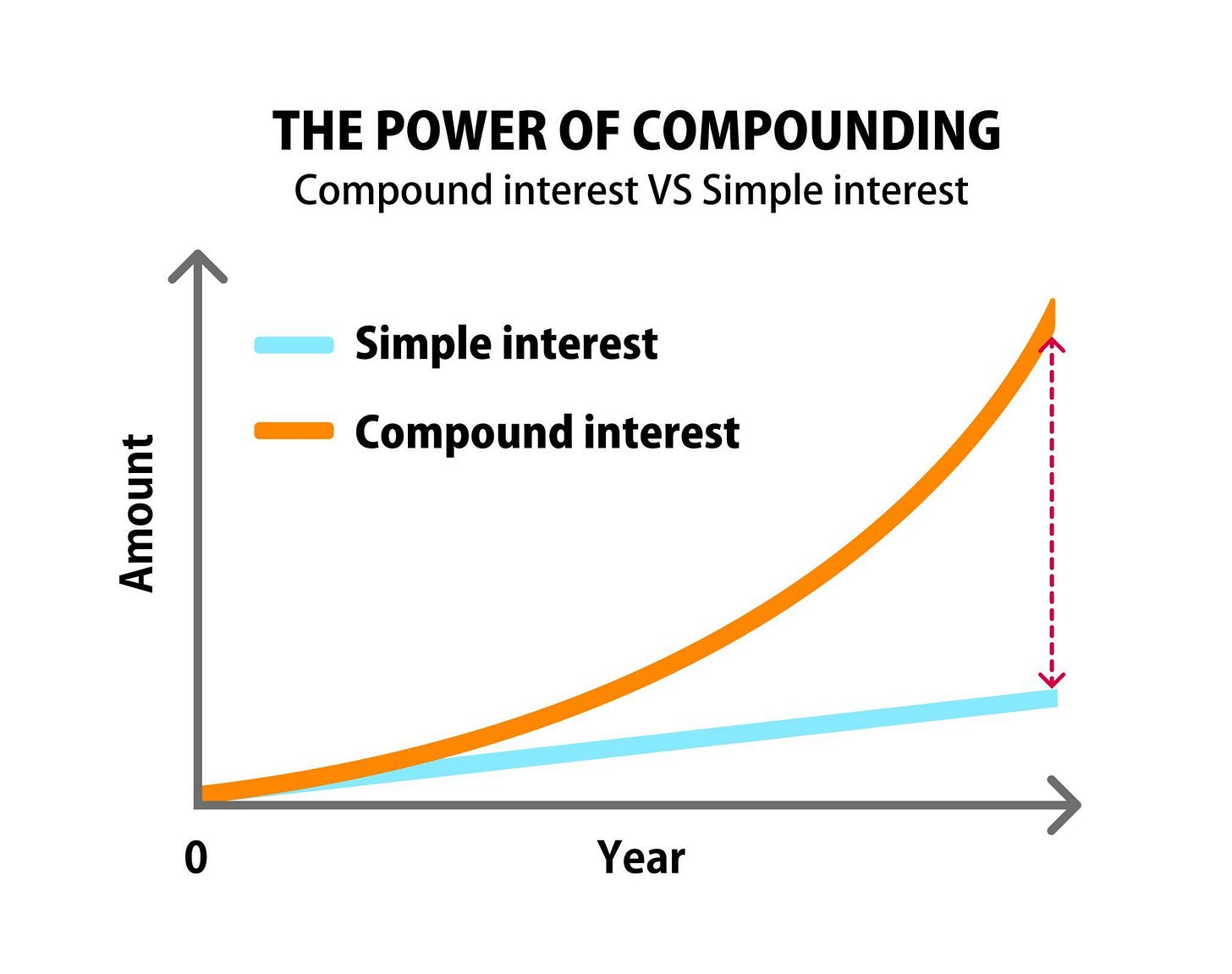

The path to financial freedom can often seem daunting and beyond reach but with the right approach it can be turned into a simple process with a high probability of success. The key to this success is to harness the power of compounding which is the payment of interest upon interest, upon interest, and so on, ad infinitum. The purpose of this site is to help individuals at all stages of their financial journey to benefit from the power of compounding by building their own Compounding Machine while managing risk along the way.

The Power of Compounding

Compounding is the payment of interest on interest or when investing in trading companies (known as equities), it is the reinvestment of dividends that creates the compound effect and this is accelerated when combined with capital growth. The very best companies are able to generate surplus profits that can be both reinvested in the business for future growth and also, make a regular return to shareholders via the payment of dividends. The capital growth is driven by increased earnings (profits) which in turn drives increased dividends which then creates the opportunity for accelerated compounding. It becomes a virtuous circle!

In the early years of reinvesting dividends the returns can seem quite mundane but over time the combination of dividend reinvestment and capital growth help to create a snowball effect on the size of your portfolio, if left uninterrupted. Depending on your lifestyle needs, the same compounding machine can then be used to fund a retirement that keeps pace with inflation, ad infinitum.

Tax Wrappers

The legitimate avoidance of tax is a key aspect of compounding returns. That is, the less tax you pay, the more money that is available to reinvest and grow the size of your portfolio. In the UK, Individual Savings Accounts (ISAs) are a key vehicle for growing your returns free of both capital gains and dividend tax and ultimately, withdrawing money free of income tax. For many individuals there is also the option of using a Self Invested Personal Pension (SIPP) where tax relief is provided at the front end but when the time comes, withdrawals are subject to the payment of income tax.

Pound Cost Averaging

During the growth or accumulation phase when you are adding money to your compounding machine, you have the benefit of Pound Cost Averaging which is making regular additions periodically (e.g. savings from employment). That is, you are able to benefit from both rising and falling prices of the natural volatility that occurs in the stock market. Equities tend to rise over time but occasionally the market experiences a sell-off or correction. At these times, the regular saver is able to buy more shares or units at a lower price. It is this time in the market that is likely to be more beneficial than trying to time the market.

Accumulation versus Drawdown

Typically, what often happens with retirement strategies is that people focus on growth (and perceived higher risk) during the accumulation phase and income (and perceived lower risk) during the drawdown phase. The entire basis of The Compounding Machine debunks this theory and focuses on total returns regardless of which phase you are at. The difference is that in the accumulation phase dividends can be reinvested whereas in the drawdown phase dividends can be withdrawn to provide an income. This does not detract from the underlying investment still compounding by growing both profits and dividends over time and therefore, continuing to grow the portfolio over time.

The Safe Withdrawal Rate

If you are asking yourself questions like; When can I retire? How much do I need to retire? How long will my money last? It is important to understand the safe withdrawal rate. That is, the rate that you can safely withdraw from your portfolio each year without running out of money and whether this amount meets your own lifestyle requirements. Ideally, your safe withdrawal rate will be aligned with the natural yield of the portfolio (i.e. covered by dividends being received) so that the underlying portfolio continues to grow even when you are drawing an income from it.

The global equity benchmark that we use within The Compounding Machine yields around 1.5% which means you can expect an income of £15,000 for every million pounds accumulated. For many people, that is unlikely to be sufficient and one thing that we do within The Compounding Machine is offer ideas on how to increase the natural yield of the portfolio while still compounding returns. Typically, this means that we target a natural yield of 3% to 5% overall.

Sequencing Risk

One of the challenges faced when moving from accumulation to drawdown is sequencing risk. While volatility can be the friend of the compounding investor during the accumulation phase, it can be their enemy in the early stages of the withdrawal phase. That is, if you move from accumulation to drawdown at a time of heightened volatility, you might find yourself exposed to the negative compounding effect of withdrawing funds from a falling portfolio. One way to mitigate this is to only withdraw the natural portfolio yield but we also advocate planning for the transition a couple of years ahead by withdrawing the portfolio’s dividends into cash savings, thereby providing a buffer to protect against sequencing risk.

What is the Compounding Machine?

My name is Simon and I have built and run my own compounding machine for over a decade. It is called the Compound Growth & Income Portfolio (CGI) and I have shared my journey publicly and for free on the Share Knowledge blog where I shall continue to publish regular updates. This period has included Brexit, Trump 1.0, The Covid Pandemic, High Inflation, Rising Interest Rates, Trump 2.0, Liberation Day Tariffs and geopolitical strife. Over this time, my returns have averaged over 20% per annum.

However, my compounding machine cannot be copied. It is based on my own appetite and tolerance for risk, my own research, my own levels of conviction, my own circle of competence and my own financial needs. For example, my largest two holdings are over 30% of my portfolio. I only have 16 holdings in total. And my smallest holding is over 4% weighting. These are all things that have evolved over time and not appropriate for anyone else to try and copy now, over ten years down the line.

But the process can be copied and the approach adapted for individual needs. That is why I have created The Compounding Machine - to demonstrate how I would go about building a compounding machine if I were to start from scratch today and also to provide additional ideas that you might like to research for your own compounding machine. This includes funds such as Investment Trusts (actively managed equity portfolios), Exchange Traded Funds (passive funds that track a specific index) and Direct Equities (individual companies that have demonstrated a track record of compounding returns, identified via a process of stock screens and individual company analysis).

Why Subscribe to the Compounding Machine?

Before answering that question let me share with you a cheat code. There are single funds you can invest in that can do the job for you. They are called Global Trackers and these invest in a widely diversified portfolio of the largest companies across the world. Historically, these trackers have returned around 7-8% annual returns and pay a dividend of around 1.5% per annum. If you are young and time is on your side, this is probably the best option for you – invest regularly into a global tracker and let your money accumulate in the background while you get on with enjoying your life.

But if you really want to take control of your own financial future and perhaps accelerate the process and/or increase the dividend yield, building your own compounding machine is a really good way to become financially independent, over time. And this is where a subscription to The Compounding Machine can help.

- A model portfolio built and managed by an experienced and successful private investor

- Monthly digest of ideas for Investment Trusts and Exchange Traded Funds (ETFs)

- Monthly stock screens

- Individual Company Analysis and Stock Reports, supported by AI

- Exclusive subscriber podcasts

Compelling Value

Did I mention all of this is being provided for FREE? Subscribe now so that you receive all new content direct to your inbox.