Laying Global Foundations

Building a Compounding Machine: Part One

Please read the disclaimer before proceeding.

In the Cheat Code I made the case for compounding returns on autopilot by simply investing in a global equity tracker such as the Vanguard Life Strategy 100. Therefore, it follows that everything else I write on these pages is aimed at enhancing that strategy either via improved capital returns, improved dividend income or ideally, both.

Structuring the Portfolio

My plan is to construct a Compounding Machine with three segments:

Segment 1 – A Global Base using ETFs and/or Investment Trusts. In the model portfolio, my plan is for this to account for 50% of the fund and I regard it as the lowest risk. There is no reason why this segment could not be an entire fund in its own right.

Segment 2 – Themed ETFs and/or Investment Trusts. These satellites tend to be based on sectors or countries that we might want enhanced exposure to at any given time. My plan is for this segment to account for 30% of the fund and I regard it as medium risk.

Segment 3 – Direct Equities. Investing in individual companies is by far and away the riskiest part of this portfolio (because of increased volatility and idiosyncratic risk) but if we can find the right companies, they are also the component that can help our model portfolio to outperform. My plan is for this segment to account for 20% of the fund but I would encourage subscribers to regard this layer as an optional extra. In particular, if you are going to invest in individual equities, you must be prepared to conduct detailed research and monitor the news flow related to the companies you invest in.

Selecting a Global Equity ETF

In this model portfolio, I’m going to replace the Vanguard Life Strategy product with a global ETF (Exchange Traded Fund) which will also act as the benchmark for the portfolio. Both of the largest ETF providers, Vanguard and iShares (owned by Blackrock) provide a global equity option and each of these has a distribution option (where dividends are paid out to shareholders quarterly) and an accumulation option (where dividends are automatically reinvested). As we will be rebalancing the portfolio each year and some subscribers will also want to use their own compounding machine for regular withdrawals, I’m going to use the distribution product in the model portfolio but for investors who want to take a more hands-off approach, the accumulation version might suit.

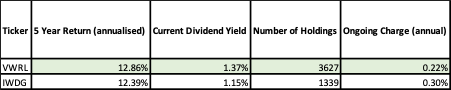

Let’s compare the two products; Vanguard All-World (ticker VWRL for the distributing product and VWRP for the accumulation version) and iShares Core World (ticker IWDG for the distributing product and SWDA for the accumulation version).

In this instance, VWRL marginally edges the comparison on each dimension and while past performance is never any guarantee of what might happen in the future, I am comfortable making VWRL the linchpin and benchmark of our model Compounding Machine portfolio.

Global Equity Investment Trusts

Investment Trusts are actively managed funds that aim to beat a specified benchmark. In the case of global equity trusts this is usually either the MSCI or FTSE All-World Indices and we should therefore, expect them to charge a little more than a product that merely tracks one of these indices.

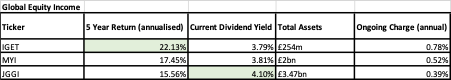

The Association of Investment Companies (AIC) have an excellent website that can be very useful for researching and comparing investment trusts. At the time of writing there are 10 companies in the Global Equity category and 6 companies in the Global Equity Income category. Based on the 5-year performance, here are the top 3 companies in each category, all of which have outperformed the global ETF tracker over that period.

I want to select the best 3 funds overall. The first 2 are straightforward as both Invesco Global Equity Income (IGET) and Murray International (MYI) are not only the top performers over 5 years but they also pay a higher dividend than the Global Equity category. The third spot is a closer call. Brunner Investment Trust (BUT) has returned 16.29% annualised and pays a dividend of 1.82% (total 18.11%) against a slightly lower return for JP Morgan Global Growth & Income (JGGI) of 15.56% annualised but with a higher dividend of 4.10% to give a total of 19.66% which means it just clinches it.

A reminder once again though that past performance is not a guarantee of future returns and to this end, I will review each of these holdings annually to ensure their inclusion in the model portfolio remains justified.

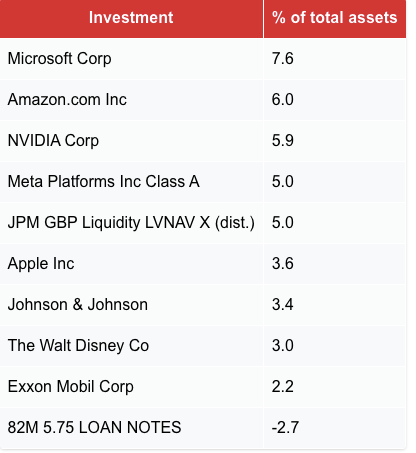

Another piece of data that can be obtained from the AIC website is the latest top 10 holdings for each investment trust. Here are the top 10 holdings for the three trusts that we are including in the model portfolio.

Invesco Global Equity Income (IGET)

Murray International (MYI)

JP Morgan Global Growth & Income (JGGI)

On the basis of there being no point in having a dog and barking yourself, I don’t intend to pass judgement on these holdings directly as this is for the active managers to decide. However, it is interesting to note that there is very little duplication between each of these three funds. This gives me further comfort that we have useful diversification in our model portfolio.

Gold

Finally, I would like to include an allocation to physical gold in our portfolio. As the saying goes, ‘include an allocation of 10% gold in your portfolio and hope that it doesn’t go up’. This is because gold, while not usually a compounder, provides catastrophe insurance for a portfolio. Let’s be clear, if there is a market crash (more than 20% decline) or correction (more than 10% decline), gold is likely to fall along with just about everything else. This is because when there is a general market sell off liquidity dries up and forced sellers (for example, investors and hedge funds who are receiving margin calls) will sell whatever they can and as gold is usually quite a liquid asset, it gets sold and the price goes down, at least in the very short-term.

At this point it is worth reminding ourselves that this type of market volatility is a) normal and b) the friend of the compounding investor because it enables them to buy more shares/units at lower prices.

However, the type of catastrophe that gold provides insurance for is monetary, such as currency debasement or devaluation, hyperinflation, trade and physical wars. The world is potentially going through something of this nature at the moment. Government debt is at all time highs, many central banks are de-dollarizing (replacing dollar reserves with gold) and talk of a global monetary reset is rife. Therefore, it seems prudent for the time being to have an allocation to gold in our model portfolio.

My preferred vehicle for owning physical gold is RMAP which is an Exchange Traded Commodity (ETC) backed by the Royal Mint. An alternative option would be iShares Physical Gold ETC (SGLN).

Summary

The Global Foundation is the lowest risk segment of our Compounding Machine. Given that our primary aim is to outperform a global tracker fund, this segment should achieve that most of the time and therefore, some investors might choose to restrict their own portfolio to just this segment and that might indeed be a good choice over the long-term. For our model portfolio we are going for a little more risk in pursuit of higher returns but for now, this is our global foundation:

Vanguard All-World ETF (VWRL) 10%

Invesco Global Equity Income (IGET) 10%

Murray International (MYI) 10%

JP Morgan Global Growth & Income (JGGI) 10%

Physical Gold (RMAP) 10%

The average dividend yield of this segment is currently 2.61% or 3.26% if excluding gold.

In the next article, I’ll take a look at a long list of ETFs and Investment Trusts that might qualify for the Themed Satellite segment of our Compounding Machine. Make sure you subscribe to ensure all new posts and updates are delivered directly to your inbox.

Disclosure

At the time of writing the author of this article owns shares in:

Invesco Global Equity Income (IGET)

JP Morgan Global Growth & Income (JGGI)

Physical Gold (RMAP)

I would definitely have AGT as a core holding (in fact I do IRL). It has an asset value based approach which distinguishes it from the others, I would expect it to outperform the others in a contracting market and adds an extra bit of style diversification to the portfolio:-)

Thanks for sharing Doogie. It certainly has an interesting top 10 and it was on our initial shortlist. For sure, it is worthy of further research.