The Cheat Code

How to Compound Returns on Autopilot

While it can put you in control of your financial future, building your own compounding machine can be time consuming and carries additional risk over and above simply owning a global market tracker. For many people, this option of owning a global tracker is the right one and should automatically compound your investment returns over time. This is especially true if you are young and have time on your side. Why not just put your investments on autopilot and get on with enjoying life?

A cheat code for doing this is covered here in this article.

Equities versus other Asset Classes

But first, we should start with some definitions:

Equities – Trading companies that are owned by shareholders that usually share their profits with these shareholders via dividends and/or share buybacks. Good companies also reinvest some of the profits back into the business in order to grow future profits and dividends.

Bonds – These are debt instruments that pay interest. They can be government bonds (these are called Gilts in the UK and Treasuries in the US) or corporate bonds issued by companies. Bonds can be purchased and traded by investors in much the same way as equities. Interest is paid at stipulated frequencies (monthly, quarterly, bi-annually etc.) and can be reinvested to create the compounding effect. There are also funds that will do this for you. However, beyond the effect of earning interest upon interest, bonds do not compound in the same way that trading companies (equities) do. Bonds also have an expiry date upon which the capital is returned to the bondholder for the money to be reinvested into another asset.

Property and Infrastructure – These are assets that are usually bought via funds. There are open ended funds (known as OEICs – open ended investment companies) where investors are able to withdraw capital on request. If a lot of investors try to withdraw in a short space of time, the fund managers might not be able sell these illiquid assets quickly enough and will need to gate the fund (suspend withdrawals) until they are able to do so. For this reason, I would only ever buy a property fund that is within a closed ended structure such as a Real Estate Investment Trust (REIT) or Exchange Traded Fund (ETF).

Commodities – These are real assets such as gold, silver, copper, lithium, rare earth minerals, oil etc. There are some funds that provide exposure to these commodities via producers (i.e. specialist equity funds) but it is also possible to own some of these assets via Exchange Traded Commodities (ETCs) which typically do not pay a dividend but do provide exposure to the underlying price of the asset.

Cash – can be invested in savings accounts that pay interest or via money market funds. Generally speaking the interest paid is unlikely to keep pace with inflation and is therefore, not very good at compounding returns over time. Reinvesting interest will provide some growth over time but that growth is likely to be sub-par compared to other assets.

Long Story Short

I prefer to invest in equities rather than bonds, although the latter can be used to diversify risk and reduce portfolio volatility. Property and Infrastructure investments can be useful to boost income in retirement and perhaps diversify risk but will not generally compound returns unless the asset price is rising (it would be a mistake to think that property always goes up and as for infrastructure assets, they often need replacing). Investing in commodities via ETCs is generally a trading play on the price of that commodity and not ideally suited to compounding returns over the long-term. Neither do commodities tend to pay a dividend unless investing in the commodity producers (equities).

The Cheat Code

Vanguard offers a series of LifeStrategy Funds that offer a mix between bonds and 20%, 40%, 60% or 80% equities along with an option for 100% equities. Given that we are looking to set up a forever fund and equities tend to outperform over time, my preference would be for 100% equities. This fund in particular is extremely safe and comprises over 6,000 companies, even though the risk rating is shown as 5/7, it is probably one of the safest equity funds on the market.

This is because the financial regulators, in their wisdom, classify equities as a higher risk than other asset classes, including cash which is more or less guaranteed to lose you money in real terms. What they really mean by risk is volatility. And yes, equities do tend to be more volatile than most asset classes but for the compounding investor, volatility is your friend during the accumulation phase of your journey because it enables you to buy more shares/units at a lower price.

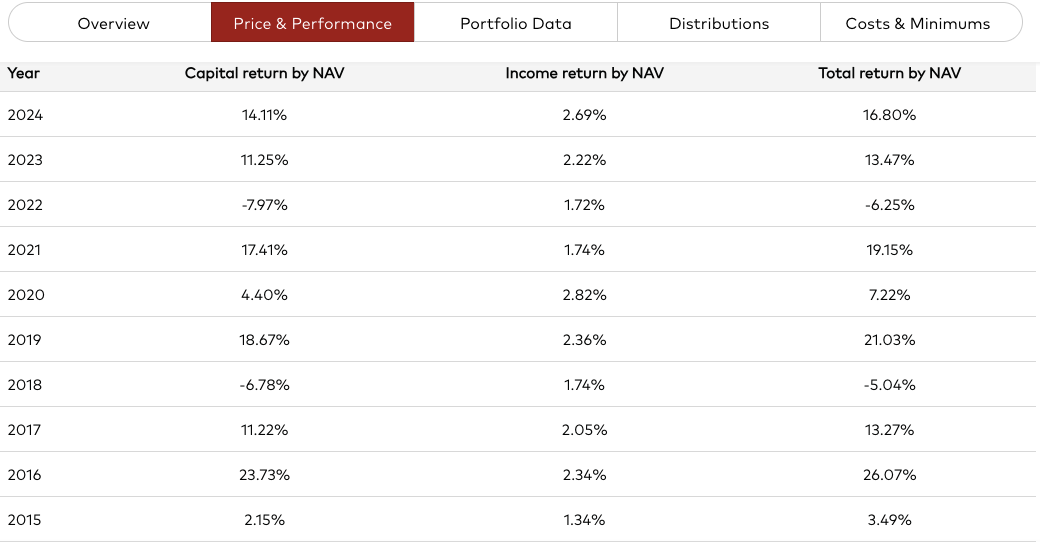

Back to the Vanguard LifeStrategy 100 Fund. It has returned an average of around 7.8% over the past 10 years (there were 2 negative years in that time) and currently yields around 1.7% which can be distributed to you for manual reinvestment/withdrawals or dividends can be accumulated and reinvested automatically if you select that option.

The annual charge for this product if investing directly with Vanguard is 0.22% and they offer both ISA and SIPP options. The alternative is to open an account with a stockbroking platform such as Hargreaves Lansdown, AJ Bell, Interactive Investor or Trading212 (other brokers and platforms are available). This would introduce additional charges but also open up the option for buying alternative funds, such as investment trusts and ETFs (Exchange Traded Funds) which I’ll get into more when I start building The Compounding Machine.

For now, this is the cheat code. If I wanted a simple, low-cost option for compounding my savings over the long-term, Vanguard LifeStrategy 100 ticks most of the boxes. If I were able to invest a little more time in opening a stockbroking account, I could consider alternative, lower cost ETFs such as Vanguard Developed World (VWRL/VWRP) or iShares Core World (IWDG/SWDA).

I hope you have found this useful and if you decide to use the cheat code, I wish you well. If you would like to learn a little more, perhaps how to accelerate returns or how to generate a higher yield then please subscribe to The Compounding Machine to receive regular new content and ideas, including the construction of our model portfolio.